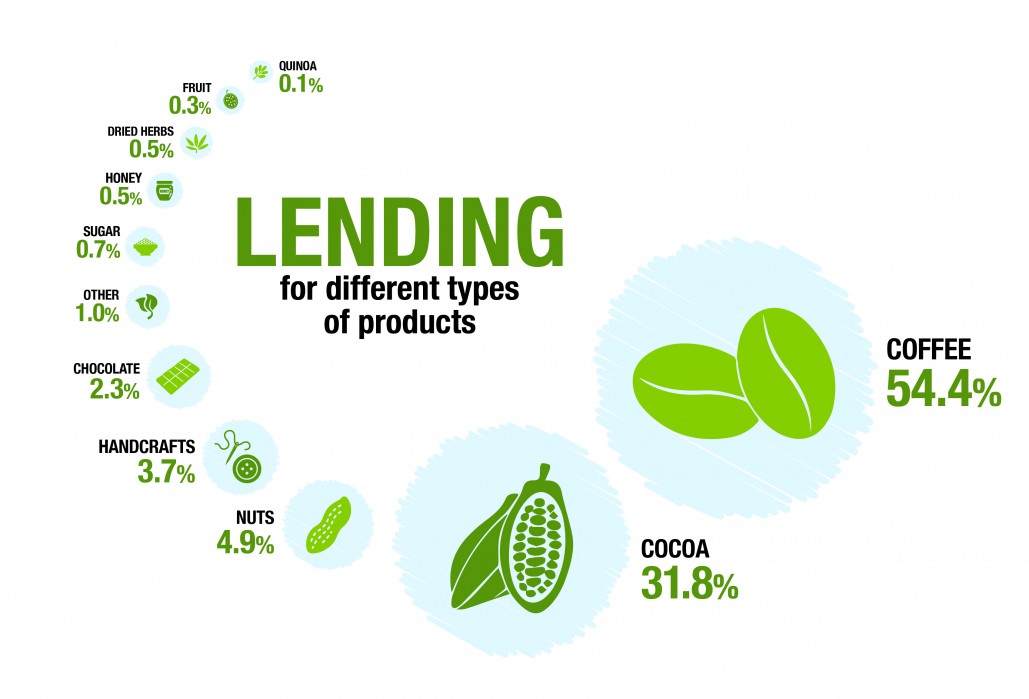

Products financed

Coffee

Coffee remains the largest sector within our value chain and the cornerstone of our Latin American portfolio, accounting for 54% of total disbursements in 2025, up from 51% in 2024. This sustained growth underscores the critical importance of coffee financing within fair trade supply chains and our capacity to respond to price and liquidity pressures in this volatile market.

John Bikuzo, farmer of Ugandan co-operative Banyankole Coffee Services (BCS), a Shared Interest customer since 2020, said:

“...A lot of benefits have been achieved from BCS, namely: coffee premium funds from our Fairtrade sales, high prices from our coffees, trainings in agroforestry, supply of quality seedlings, diversification of our income with bee projects, to mention but a few."

Global coffee prices have remained exceptionally high throughout 2025. Arabica futures (contracts to buy or sell a specific quantity of Arabica coffee at a set price on a future date) reached 15-year highs, while Robusta prices have nearly doubled year on year. Elevated contract values have significantly increased co-operative capital requirements, creating upward pressure on financing volumes.

Many have required larger or revolving facilities to manage multiple shipments within the same harvest cycle. Despite marginal softening in demand in some markets, coffee prices are expected to remain elevated due to constrained supply and regulatory-driven cost inflation. The price volatility has also accelerated facility churn, as loans were repaid and re-utilised more quickly for subsequent contracts.

This efficiency of capital deployment demonstrates both the agility of our disbursement systems and the financial discipline of our customers. However, it also reinforces the need for adaptive interest rate and risk pricing models, ensuring that facility structures can absorb price shocks without amplifying repayment risk. Climate resilience, certification and traceability investments will be increasingly central to sustaining both production and market access. The introduction of the EU Deforestation Regulation (EUDR) has further increased compliance costs, as exporters must demonstrate traceability from farm to shipment. Smaller producer organisations are facing increased administrative burdens, highlighting the continued importance of accessible finance.

Cocoa

Cocoa remains our second-largest financed product, representing 32% of total disbursements, down slightly from 35% in 2024. Most cocoa customers are based in West Africa, where producers faced production challenges and market disruptions, significantly affecting trade. Severe weather patterns, including prolonged droughts have reduced yields.

The continued spread of Cocoa Swollen Shoot Virus (CSSV) has further reduced productivity, with some co-operatives reporting harvest losses exceeding 40%. The sharp reduction in output pushed global cocoa prices to record highs in early 2025. While higher prices increased the nominal value of financing, many co-operatives struggled with quality and volume delivery, constraining export turnover. Cocoa markets are expected to remain volatile, with continued supply pressure into 2026. This context reinforces the importance of financing models that combine liquidity provision with technical and agronomic support, helping co-operatives maintain income and mitigate the impacts of climate stress and disease.

President of ECOOKIM, Ouattara Adama Aboulaye, said:

“The finance from Shared Interest has been utilised to support investment in diversification projects, farm maintenance and certification.”

Nuts

Nuts accounted for 5% of total disbursements in 2025. The sector continues to benefit from increasing consumer demand for plant-based and nutritious food products, particularly in Europe and North America. Financing activity in this segment was driven primarily by co-operatives in Peru as well as West and East Africa, with growth linked to new buyer relationships and improved post-harvest processing capacity. The sector’s seasonality and exposure to export logistics remain operational challenges but long-term demand prospects are positive.

Chocolate

Chocolate financing represented 2% of total disbursements, primarily to ethical trading organisations and value-added processors in Latin America and Europe. This reflects a growing movement toward origin processing, enabling producer organisations to capture more value domestically. These facilities often link directly to cocoa financing, supporting the development of higher-margin downstream activities. Such integrated lending not only strengthens co-operative balance sheets but also advances fair trade’s broader goal of equitable value distribution.

Handcrafts and Textiles

The handcraft and textile sectors remain small but socially vital, comprising 4% of total disbursements, on par with 2024. Global demand for handcrafts continues to be affected by subdued retail spending in key export markets, yet the sector remains central to our mission of providing finance to disadvantaged producer communities, particularly women-led and rural enterprises. While many commercial lenders have withdrawn from this segment, we remain one of the few dedicated social financiers maintaining steady engagement. Our flexible loan structures and partnerships with fair trade buyers continue to provide essential liquidity to sustain employment and preserve artisanal skills.

Other products

Other financed categories, though smaller in scale, demonstrate the breadth of our impact. The disbursement profile underscores both the concentration of our lending in coffee and cocoa sectors exposed to climate and regulatory shocks and the strategic importance of diversification into smaller high-impact product lines.

Back to menu