Types of Finance

Our finance changes lives

Despite the progress made in increasing access to financial services, the majority of people living in developing countries still struggle to access finance, particularly where the main source of income is from agriculture. Our overseas team have regularly report that producer groups are unable to obtain the credit facilities they need to grow their businesses sustainably.

Through our lending, we empower smallholder farmers and artisans to improve their business operations, access commercial markets, create employment opportunities and contribute to the alleviation of poverty in their respective communities.

We lend to support fair trade products such as coffee; fresh fruit, nuts, and cocoa, as well as handcrafts such as weaved baskets and furniture.

We want to do more than provide finance on fair terms. The organisations we finance say that, thanks to our supporters, they have helped transform their communities.

Image: TradeAID Integrated basket weaver Akolpogbila Apalawanya on a group farm in Ghana.

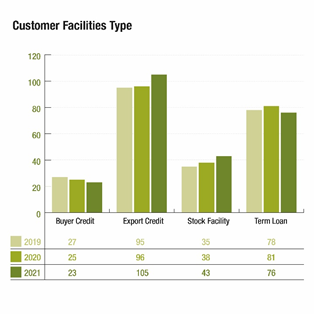

Apply for financeTYPES OF FINANCE OVERVIEW

Short-term (1 year - renewable)

- Prefinance as working capital against individual orders to facilitate trade (Export Credit/Buyer Credit) - Revolving Facility

- Stock facility to build up stock, buy seasonal raw material or support pre-harvest activities prior to fixing sales contracts

Medium-term (1 to 5 years)

- Term loan to purchase infrastructure or equipment to build capacity and/or profitability (1 to 5 years)

- Plantation renewal loan to support against the impact of agricultural pests and disease (1 to 7 years)

KEY FACILITY FEATURES

- Lending in GBP, USD or EUR up to USD

- Variable interest rates

- Interest cost is charged daily on the outstanding balance

- One-off set-up fee of 1%

- Annual renewal fees can apply

LENDING PRODUCTS FOR PRODUCERS

Export Credit

Prefinance as working capital against individual orders or contracts to facilitate trade. One of the unique aspects of Shared Interest’s export facility is the automatic mechanism where by any payments received through the producer account are used to repay monies borrowed on orders that have become overdue.

This type of finance is very important to producers as, the payment terms when they sell a product can be long and very hard to manage. Add to that the time taken to ship and deliver it overseas and this time period can extend even further. Even with careful financial management, exporting goods can place an incredible financial strain on your business. Export finance offers a way for businesses to release working capital, by providing prefinance against individual orders or contracts.

Features

- 12 month revolving credit facility for the producer available for use against specific fair trade- orders. As orders are repaid, you can draw down working capital against new orders, up to your maximum limit.

- Can only be drawn against confirmed orders from buyers who have been approved by Shared Interest (these could be commercial or fair trade buyers)

- Prefinance up to 80% of the value of any confirmed order (usually 60% for commodity orders) at the instruction of the producer. If the buyer organisation has already made a prepayment then we can prefinance the remaining percentage that will take the total level of pre-payments to a maximum of 80% (60% commodities) of the order value

- Repayment is usually made via the buyer directly to Shared Interest. The borrowing and accrued interest is repaid to Shared Interest when the buyer makes the final payment for confirmed orders to the producer through Shared Interest bank account or if also a customer via its account. The amount borrowed and interest accrued is deducted and the remaining funds are transferred.

Term Loans

To help producers build capacity and/or profitability. For example by purchasing essential equipment that will contribute to achieving overall business development.

The amounts are based on the type of infrastructure/equipment and the financial situation of the organisation. In regards of the plantation renewal, the amounts are based on the technical plan for plant renewal. The maximum repayment period is 5 years. This period can be extended to 7 years for existing coffee producer customers borrowing for plantation renewal to resolve yield issues such as leaf rust (Roya).

Features

- Disbursements are made, preferably in tranches, though the customer is allowed to drawdown the full amount. If possible payment is made direct to the supplier.

- A deferred capital repayment period of up to one year can be offered, though any interest that accrues during this period must be repaid. In this case the repayment period will be reduced to a maximum of four years thereafter, in order to ensure that the term of the loan does not exceed five years

- Repayment plans are flexible with the potential to take monthly, quarterly, bi-annually or annually repayments, either directly or via buyer payments

- Interest payments can be made on either a monthly, quarterly, bi-annually or annually basis

- Early repayment is possible and no fee is charged providing the loan has been in existence for more than 18 months

Stock Facilities

To secure stock when harvests are unpredictable and contracts have not been finalised. The limit and withdrawals are defined based on the projected cash flow.

Features

- Stock facilities may be approved for new and existing customers

- Automatic renewal in each subsequent year is possible so long as the funds are fully repaid within a 12-month period

- There must be a reasonable gap (30 days would be usual) between the repayment of one Stock Facility and the drawdown of the next

- Repayments are flexible. You may make regular repayments or a one-off repayment, either using buyer payments or direct repayments.

- There is also an option to make one off capital repayments without early repayment charges being applied

LENDING PRODUCTS FOR BUYERS

Buyer Credit

Revolving credit facilities allowing pre and post shipment credit for confirmed orders

Features

- Allows the buyer to make pre-payments to producer groups. Payments sent directly to suppliers with ability to send small amounts.

- 12 month revolving line of credit facility comparable to an overdraft, available for use against specific confirmed orders

- As orders are repaid, you can draw down working capital against new orders, up to your maximum limit

- Repayment is made directly to Shared Interest by the end of the credit period for a particular order. The buyer can benefit from a further credit period of up to 6 months after the final payment has been made

- Interest repayments made each month

- Option for multi-currency facility

Term Loans

For the purchase of infrastructure, such as machinery, buildings or vehicles, web development and working capital (1-5 years)

Features

- Disbursements are made according to the quotation or invoices, preferably in tranches, though the customer is allowed to drawdown the full amount of the loan at the outset. If possible and/or applicable payment is made direct to the supplier

- A deferred capital repayment period of up to 1 year can be offered, though any interest that accrues during this period must be repaid. In this case the repayment period will be reduced to a maximum of 4 years thereafter in order to ensure that the term of the loan does not exceed 5 years

- Repayment plans are flexible with the potential to take monthly, quarterly, bi-annually or annually repayments via direct repayments

- Interest payments can be made on either a monthly, quarterly, bi-annually or annually basis

- Early repayment is possible and no fee is charged providing the loan has been in existence for more than 18 months