Relationship management and market intelligence

During the year, our team made substantial efforts to strengthen relationships with existing customers, monitor arrears and identify new business opportunities. Engagements included trade fairs, conferences, targeted visits and producer committee meetings, reflecting a holistic approach to relationship management, market intelligence and impact-driven collaboration.

Customer visits were conducted across Latin America, East Africa and West Africa. These visits reinforced relationships, approved additional credit where appropriate, addressed operational challenges and captured emerging opportunities.

International participation at events including Biofach Germany, Specialty Coffee Association of America (SCAA) Houston and the Africa Impact Summit supported networking, the promotion of sustainable sourcing and market intelligence gathering.

In-person producer committee meetings further strengthened governance, transparency and collaborative planning, underscoring our commitment to supporting producers beyond transactional finance. Sustained in-person engagement is critical to fostering trust, supporting financial and operational resilience and enabling growth among producer communities. Strategic visits to existing customers strengthen relationships while providing real-time market intelligence and early identification of operational or financial risks.

Engagements with prospective customers reveal emerging trends, inform product development and allow tailored support aligning with market demand and social impact objectives. Collectively, these efforts illustrate customer relationship management is not only about transactional interactions, but also building networks of trust resilience and shared growth in sectors we serve.

Click here to read the full Social Accounts document.

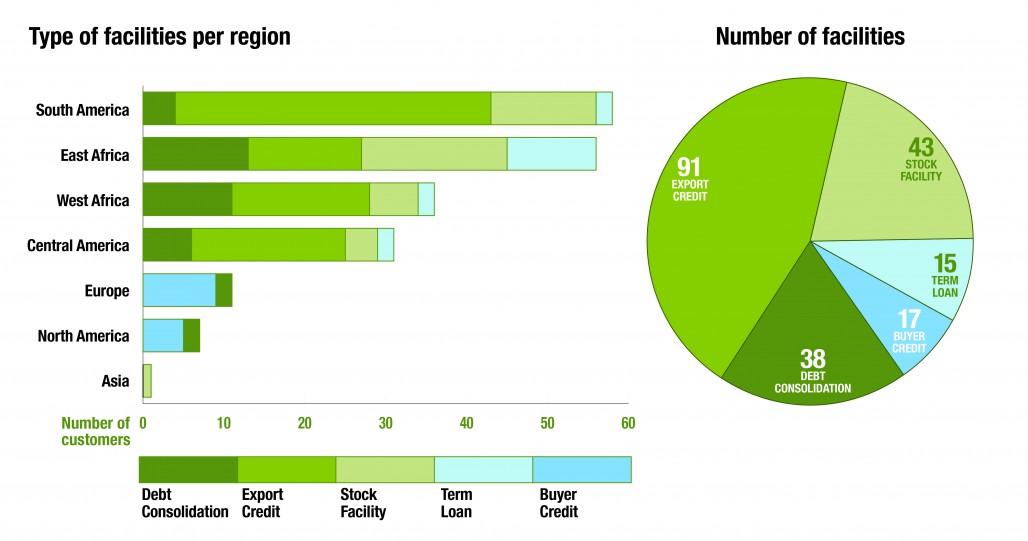

*Customers can have more than one type of facility. Europe and Asia are managed as one region as is Central America and North America.

Click here to read the full Social Accounts document.

Back to Menu