Improving income for farmers, artisans and workers

Increase in capital available to lend

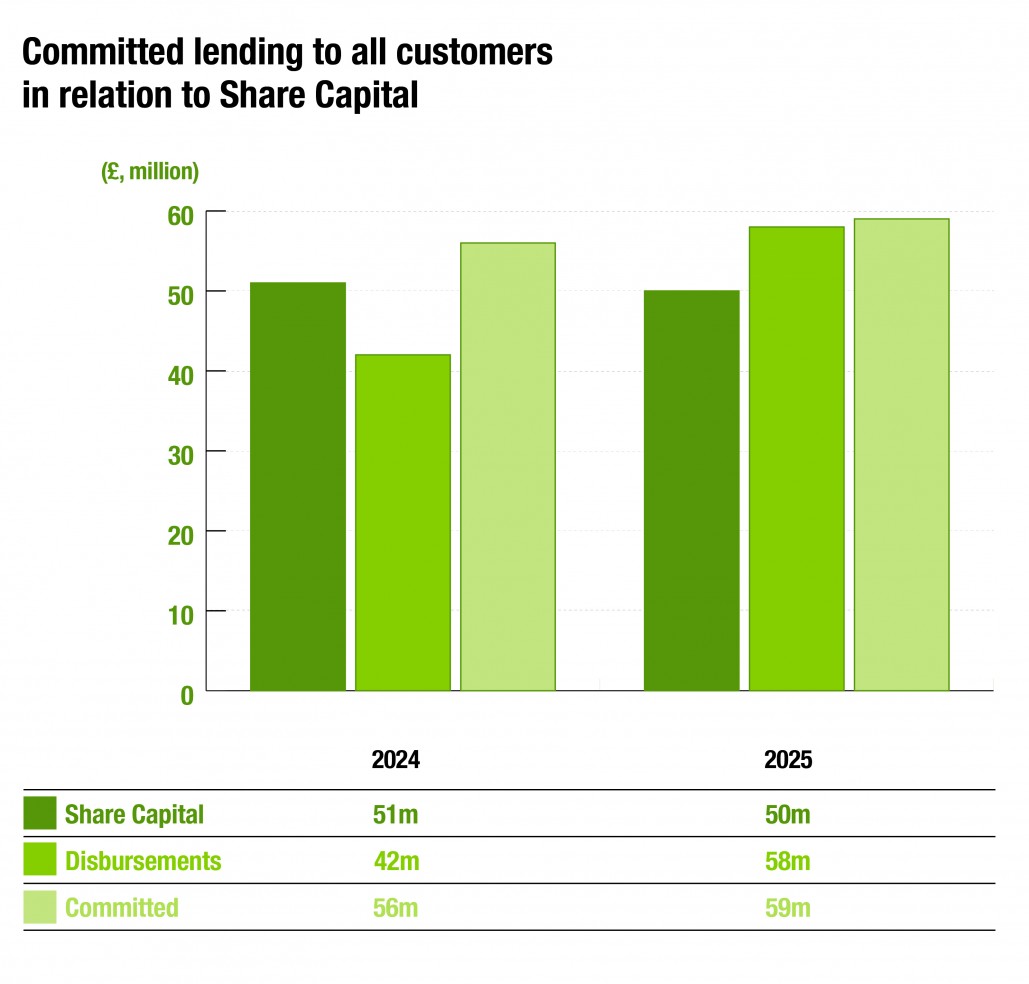

Share Capital provides the funds for our lending activities. As of 30 September 2025, total Share Capital stood at £50.5m, representing a net decrease of £0.4m compared with 2024. These funds have enabled us to continue supporting farmers and artisans who either hold recognised Fairtrade certification or adhere to the 10 Principles of Fair Trade.

The graph below shows that the total committed value of lending exceeds the value of Share Capital held. This reflects the fact that not all customers draw on their facilities simultaneously, as harvest cycles vary across regions.

Click here to read the full Social Accounts document.

To manage this exposure, we maintain a policy that the total committed value may not exceed 135% of our Share Capital. The committed value includes both short-term lending facilities ready for drawdown and the outstanding balances of Term Loans.

During the year, the number of active customers declined by one. However, the total value of committed facilities increased, as new facilities were of higher value than those they replaced. As noted, the significant rise in disbursements was largely driven by sharp increases in the prices of coffee and cocoa, which led to higher working capital needs among organisations.

Access to fair and affordable finance

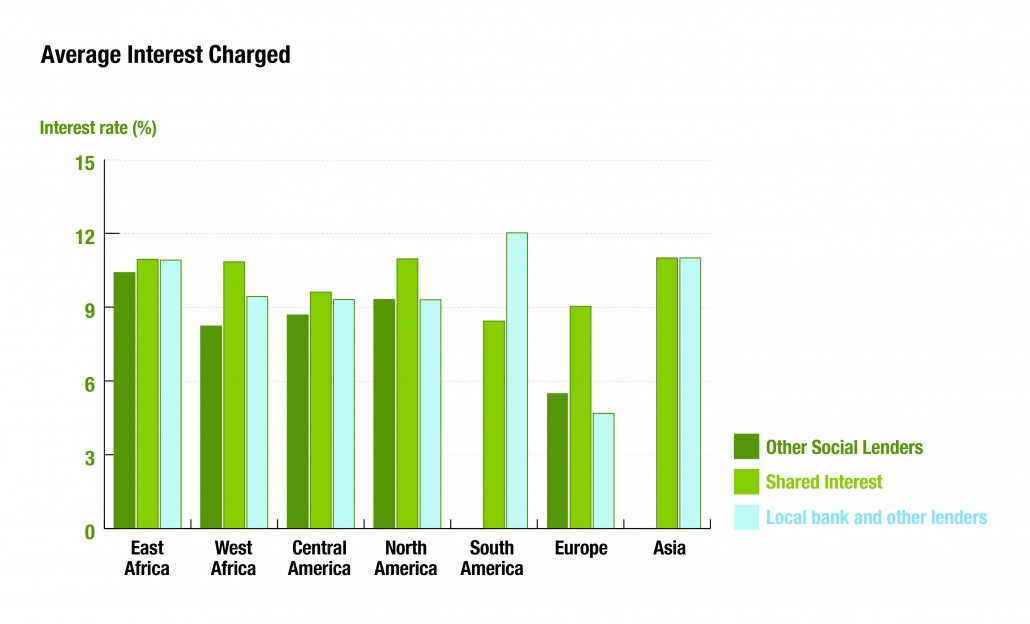

The majority of our lending is denominated in EUR and USD, yet most of our capital is held in GBP. This imbalance requires us to absorb the associated foreign exchange management costs, which in turn affect the lending rates we charge. Absorbing these costs while maintaining competitive rates that reflect the underlying portfolio risk is a constant challenge.

Our interest rates are not directly comparable to other lenders due to variations in fee structures, collateral, and lending terms; our pricing reflects a unique balance of risk, sustainability, and social purpose. Our focus on vulnerable producer groups often entails higher financial uncertainty, which necessitates higher interest rates to safeguard our members’ investments.

In response to these pressures, we have adopted proactive measures. A key initiative has been the enhancement of security requirements for new and renewed facilities. In some cases, this has allowed us to reduce interest rates, helping us remain competitive while upholding prudent risk standards.

We also continue to offer selected customers the option of paying an upfront annual fee in exchange for lower interest rates. This flexible arrangement appeals to borrowers seeking to minimise long-term finance costs.

Feedback gathered through producer committees has consistently highlighted the speed of disbursement and the flexibility of our financing options as key strengths that differentiate us from other lenders. Customers value our year-round access to funding, which contrasts with social lenders who require full repayment of existing loans before new disbursements are approved, a condition that can add unnecessary strain to cash flows.

In addition, customer feedback indicates consistently high satisfaction with the efficiency and reliability of our disbursement process, which continues to meet established service benchmarks. Improvements in our monitoring and communication practices, including greater transparency in transaction tracking and more timely updates on disbursement and order status, have enhanced operational predictability and strengthened trust in our financial management systems.

Farmer income data indicates a strong upward trend during the reporting period, largely driven by favourable global market dynamics, particularly for commodities such as coffee and cocoa.

Producer Income

79% of farmers reported higher income levels, with strong international prices for key commodities compensating for production shortfalls in several regions. This improvement suggests a gradual strengthening of economic resilience among smallholder farming communities.

Similarly, 74% of artisan organisations reported an increase in income, a significant improvement from the previous year, reflecting renewed market demand, improved product diversification, and recover from post-pandemic trading conditions. Conversely, only 8% of farmers and 13% of artisan customers experienced income declines, indicating that gains were widespread but not yet universal.

Sales and Orders

Overall, 88% of customers reported stable or improved sales, demonstrating resilience across key commodity sectors. The upward trend in sales was largely driven by higher international coffee prices and the strategic benefit of diversification, including the development of specialised cocoa varieties.

Orders were even more positive, with 47% of respondents reporting growth and only 17% experiencing a decline. These findings suggest that customers with stronger product diversification and certification profiles are better positioned to sustain or increase sales in a fluctuating market environment.

Employees and Workers

The income levels for employees and seasonal workers remained largely stable, with 69% of employees and 61% of seasonal workers, indicating that their earnings had not changed. Only 9% of employees and no seasonal workers reported a decrease in income, pointing to a degree of wage stability.

These findings highlight encouraging progress, reflecting the impact of stronger trading relationships, diversified income opportunities, and sustained efforts to support economic resilience and fair remuneration across their value chains.

Back to menu