Building stronger, more resilient and sustainable businesses

Onboarding new organisations showed steady improvement over the period, reflecting a gradual recovery in lending appetite and operational capacity across several producer regions. We approved ten new facilities with a combined value of approximately £2.9m.

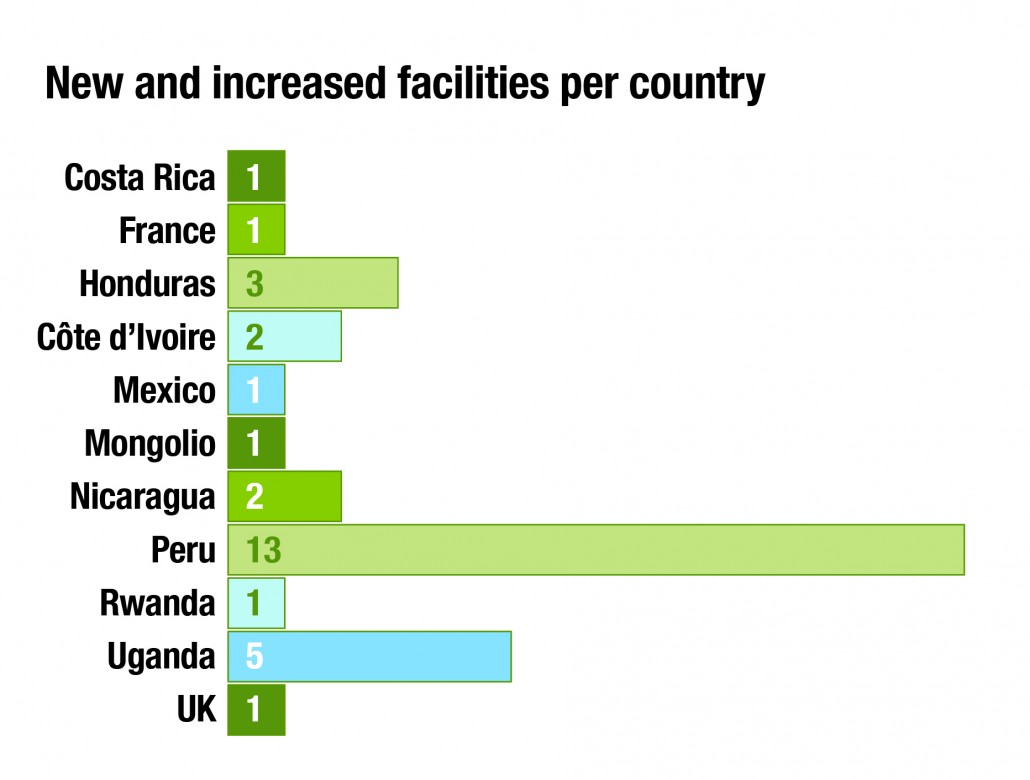

This represents a meaningful increase in outreach and diversification compared to the previous year, during which new lending remained subdued. The new facilities extended across six countries, Côte d'Ivoire, Honduras, Mexico, Peru, Uganda and the United Kingdom. This demonstrates our ongoing efforts to build a geographically balanced portfolio.

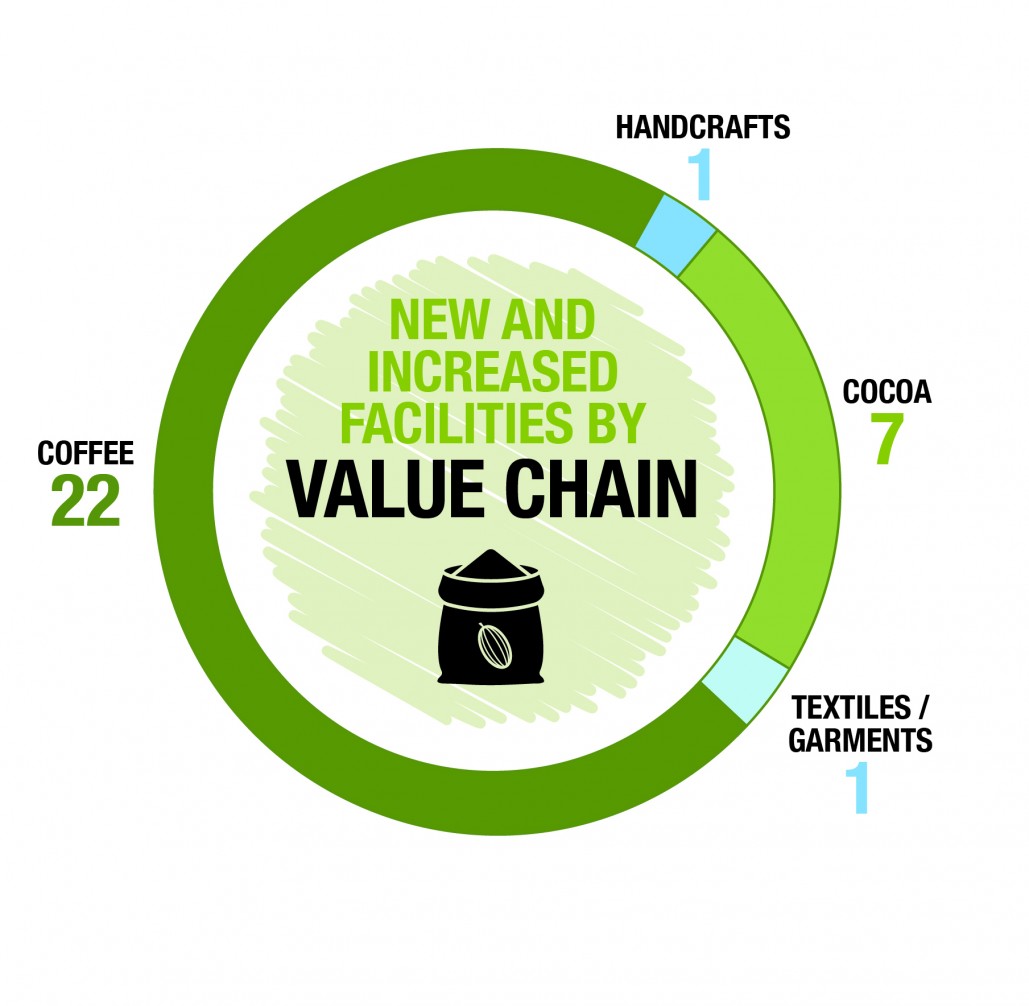

While seeking diversification, coffee continued to account for the largest share of new approvals, with seven facilities worth around £2.4m. Additionally, the cocoa sector was supported with two facilities worth around £500k in Côte d'Ivoire and Uganda. One credit facility of £50k was extended to a UK-based textiles and garments enterprise.

Beyond new relationships, we maintained a strong focus on reinforcing those with existing customers. Over the same period, 21 existing facilities were renewed or increased, with a total value of approximately £3.7m. These included a mix of Working Capital, Export Credit, and Stock Facilities, each tailored to the specific cash flow cycles of producer organisations.

We provided two term loans to coffee organisations demonstrating how we not only supports trade finance, but also address long-term sustainability needs, helping to generate production efficiencies and boost profitability.

Despite challenges, the year’s results demonstrate tangible progress in expanding outreach, particularly in Sub-Saharan Africa and Latin America. The mix of new and repeat facilities reflects a balanced approach, supporting long-standing partners while welcoming new organisations into the portfolio. Continued efforts will focus on improving value chain diversity and identifying opportunities in emerging producer markets with strong sustainability credentials.

Click here to read the full Social Accounts document.

Back to menu